The most significant issue with payday loans is they have got APRs as high as four hundred%. Coupled with the quick repayment conditions, these superior APRs make the loans hard to repay. Borrowers typically drop into a cycle where they have to borrow A different payday loan to repay the last one.

Take your loan offer you: Based upon your lender and the information you offer, you may get yourself a loan present promptly. Be sure to’re happy with the curiosity price, and be sure you study the fine print right before signing your loan paperwork.

Many factors impact the desire price a lender may well offer you on a private loan. However, you usually takes some measures to spice up your probability of acquiring a lessen curiosity fee. Here are some techniques to test.

Financial debt-to-revenue (DTI) ratio: This ratio represents the amount of of the cash flow goes to repay your debts each month. As a result, it can help lenders see simply how much of the hazard you're when they approve you for a loan.

A very low credit score tells a lender you could have struggled to help make payments toward credit playing cards or other debts in the past, so the lender may be taking on more hazard by loaning you dollars. This is able to induce the lender to deny your software or approve a small loan at a high APR.

Own loan repayment phrases can vary from just one to many many years. Typically, shorter conditions feature reduced desire rates, For the reason that lender’s revenue is in danger to get a shorter time period.

In case you’re charged an origination payment, make certain the loan amount is still sufficient to address your expense as well as payments are still cost-effective.

Most effective Egg has the highest minimal credit rating requirement of any lender on our record, but provides a lower bare minimum APR for borrowers with excellent creditworthiness.

Income: Pretty much all lenders request you in your profits and work information and facts. This is to ensure that your source of profits is sufficient to repay the loan. Some corporations might have an cash flow threshold before you decide to can borrow.

“I was born in Guatemala and don’t have an extended adequate credit background to obtain a loan listed here. This Kiva loan purchased a van and expanded my small business.”

In case you are considering implementing to get a small individual loan, right here’s the best way to start out: Pre-qualify: Most lenders help you pre-qualify for private loans.

Take up portion-time perform inside the gig economy. You'll be able to do the job all on your own time with gig get the job done get more info like rideshare and foodstuff delivery apps. These excess Employment may well permit you to make plenty of income to negate the need for your loan.

Own loan desire premiums range based upon your rating and also the qualification specifications you meet, so that you shouldn’t hope for getting the bottom rates or essentially the most favorable phrases with ruined credit.

The most effective lenders for small personal loans have loan quantities starting as little as $1,000, as well as several different repayment phrases. Credit unions are often very good choices for small loan quantities, but we included even larger on-line financial institutions in our listing of finest selections also.

Danica McKellar Then & Now!

Danica McKellar Then & Now! Tina Majorino Then & Now!

Tina Majorino Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Jane Carrey Then & Now!

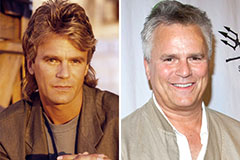

Jane Carrey Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!